OpenAI Signs $10B Deal with Cerebras, Anduril Moves to Production, Perplexity’s Data Deal

By Stableton on January 21st, 2026

This week reveals where power is consolidating in private tech. Control over compute, production, and data is shaping the next generation of market leaders. Let’s dive in…

THIS WEEK’S BREAKING NEWS

OpenAI signs $10B infrastructure contract with Cerebras

OpenAI has signed a multiyear computing agreement with Cerebras covering roughly 750 megawatts of capacity, with the deal valued by sources at more than $10B. The infrastructure will be built through 2028 and targets faster AI inference. The partnership strengthens Cerebras’ position as an alternative to Nvidia as OpenAI accelerates large-scale AI infrastructure deployment. (1)

STABLETON MORNINGSTAR PITCHBOOK UNICORN 20 STRATEGY

The Stableton Morningstar PitchBook Unicorn 20 strategy is the world’s first passive, systematic, and semi-liquid approach to investing in the Top 20 privately held tech companies before they go public.

This strategy offers a straightforward and cost-effective way to gain exposure to leading private technology companies within a single portfolio. With no performance fees and enhanced liquidity, it offers a unique alternative to traditional private market investments.

PORTFOLIO NEWS

Anduril secures $23.9M Marine Corps production contract after 13-month testing

Anduril secured a $23.9M U.S. Marine Corps contract to supply more than 600 Bolt-M loitering munition systems under the OPF-L program, following 13 months of testing and an initial delivery of 250 units. The next phase runs from February 2026 to April 2027, with production scaling beyond 175 systems per month, underscoring rapid industrialization of precision defense capabilities. (2)

Sequoia backs Anthropic in $350B funding round

Sequoia Capital is preparing its first-ever investment in Anthropic as part of a funding round targeting $25B or more at a $350B valuation, more than doubling the company’s value in four months. The round is led by GIC and Coatue, with Microsoft and Nvidia committing up to $15B. Revenues have scaled from $1B to roughly $10B annualised, and IPO preparations are underway. (3)

Anthropic launches Claude Cowork, a file-managing AI agent for enterprise desktops

Anthropic has launched Claude Cowork, a general-purpose AI agent that can autonomously manage, analyze, and create files across a user’s desktop. Available as a research preview to $100–$200 per month subscribers, Cowork extends Claude Code’s capabilities to non-technical users, positioning Anthropic closer to enterprise productivity tools like Copilot while raising competitive pressure on workflow-specific AI startups. (4)

Anthropic strengthens Python supply-chain security with $1.5M commitment

Anthropic has pledged $1.5M over two years to the Python Software Foundation to advance security across the Python ecosystem. The partnership prioritizes proactive supply-chain protection for PyPI, including automated review of all uploaded packages and a malware dataset, extending PSF’s security roadmap beyond reactive checks toward systemic, ecosystem-wide risk mitigation. (5)

Applied Intuition opens Florida hub for defense AI

Applied Intuition has opened a new office in Fort Walton Beach, expanding its footprint in U.S. defense autonomy and reinforcing its growing role in military AI applications. The company develops aerial and air-combat autonomy software and recently secured a defense contract with Sierra Nevada Corporation. The new site strengthens Applied Intuition’s defense execution capacity while creating high-skilled technology jobs in Florida’s Panhandle. (6)

Kraken-backed SPAC files for $250M Nasdaq IPO

Kraken has sponsored a new SPAC, KRAKacquisition Corp, which has filed for a $250M IPO on Nasdaq to target businesses across the cryptocurrency ecosystem. The vehicle provides Kraken with an alternative route to public-market expansion, following its own $500M private raise at a $15B valuation and recent acquisition of tokenization firm Backed Finance, as crypto-linked listings regain momentum. (7)

OpenAI introduces ads to fund ChatGPT expansion

OpenAI is introducing advertising to ChatGPT, testing ads on its free and lowest-cost paid tiers as it seeks new revenue to fund large-scale compute expansion and compete with Google and Anthropic. Ads will appear below responses and are expected to generate low billions in revenue in 2026, alongside talks for a potential $80B funding round. (8)

OpenAI leads $250M Merge Labs BCI seed round

OpenAI has invested in Merge Labs, a brain–computer interface start-up co-founded by Sam Altman, as part of a roughly $250M seed round valuing the company at about $850M. Merge Labs is developing non-invasive BCI technology, marking OpenAI’s first direct capital move into neurotechnology and signalling longer-term ambitions at the intersection of AI, hardware, and human interfaces. (9)

Perplexity partners with Wikimedia for AI data access

Perplexity has entered a paid data-access partnership with the Wikimedia Foundation, licensing Wikipedia content via Wikimedia Enterprise to support AI model development without web scraping. The agreement, formalised over the past year alongside deals with major tech groups, positions Perplexity closer to licensed, human-governed knowledge sources as data rights and content ownership become central issues in AI search and answer engines. (10)

Perplexity partners with BlueMatrix on institutional research AI

Perplexity has partnered with BlueMatrix, backed by Thoma Bravo, to bring AI-powered discovery to institutional research workflows. The integration allows buy-side users to query entitled broker research within Perplexity Enterprise, combining governed access, compliance, and attribution with AI-assisted analysis, without altering data ownership or training models on proprietary content. (11)

Revolut expands into Peru with full banking license

Revolut has announced plans to enter Peru and applied for a full banking license, appointing Julien Labrot as CEO to lead local operations. The move marks its fifth Latin American market and follows a secondary share sale valuing the firm at $45B. Revolut reported $4B in revenue and $1B in profit in 2024, underscoring its push toward regulated global banking scale. (12)

Stripe closes Metronome acquisition to scale usage-based billing

Stripe has completed its acquisition of Metronome to strengthen its position in usage-based billing infrastructure. The deal integrates Metronome’s metering engine, already used by companies such as OpenAI, Anthropic, and NVIDIA, into Stripe Billing. The move underscores Stripe’s view that usage-based monetization will define the next decade of software and AI economics, linking product usage directly to revenue at scale. (13)

xAI builds elite hiring unit reporting to Musk

xAI is forming a small, elite recruitment unit reporting directly to Elon Musk to secure top-tier engineering talent amid intensifying AI hiring competition. The team will pursue unconventional hiring methods focused on elite “vibe-coding” engineers. The move follows xAI’s recent $20B raise at a valuation above $230B, showing how talent acquisition is becoming a strategic weapon alongside capital in the AI arms race. (14)

OTHER NEWS

Cerebras eyes $22B valuation as IPO nears

Cerebras Systems is in talks to raise about $1B at a $22B pre-money valuation as it prepares for a public listing later this year. The valuation implies a sharp step-up from its $8.1B private round in September 2025. The fundraising coincides with efforts to diversify revenue beyond a single Middle Eastern customer and reflects renewed investor appetite for Nvidia challengers amid rising demand for specialized AI chips. (15)

Replit launches vibe coding for mobile applications

Replit has launched a mobile app creation feature that lets users build and publish iOS apps using natural language prompts, extending the momentum behind “vibe coding.” The feature integrates monetization via Stripe and positions Replit against larger AI platforms. The company is also nearing a new funding round valuing it at $9B, up from $3B in September, highlighting rapid capital formation in AI-native software tools. (16)

Polymarket tests the limits of US prediction market law at Golden Globes

Polymarket’s high-profile presence at the Golden Globes has highlighted regulatory grey zones in US prediction markets. While awards-related contracts are permitted, film box-office-linked bets raise questions under the Onion Futures Act and its 2010 amendment banning box office futures. Polymarket navigates this by separating US and offshore platforms, reflecting how jurisdictional structuring, not product design, defines regulatory compliance. (17)

ByteDance challenges Alibaba with AI-led cloud push

ByteDance is accelerating its push into China’s cloud market via Volcano Engine, using proprietary AI models, aggressive pricing, and heavy GPU investment to challenge incumbents led by Alibaba. ByteDance now holds nearly 13% of China’s AI cloud services revenue, versus Alibaba’s 23%, despite just 3% overall cloud share. The strategy leverages its data scale and AI infrastructure to diversify revenues and strengthen a future IPO narrative. (18)

Celonis powers AI-driven inventory gains at Fujitsu

Celonis is enabling AI-driven transformation at Fujitsu by applying process intelligence across inventory management at its FSAS Technologies unit. The platform delivered a 20% reduction in excess inventory and a 50% drop in inventory orders within six months, generating multi-million-dollar savings. Fujitsu is now scaling process intelligence enterprise-wide to ground AI deployment in operational context and execution. (19)

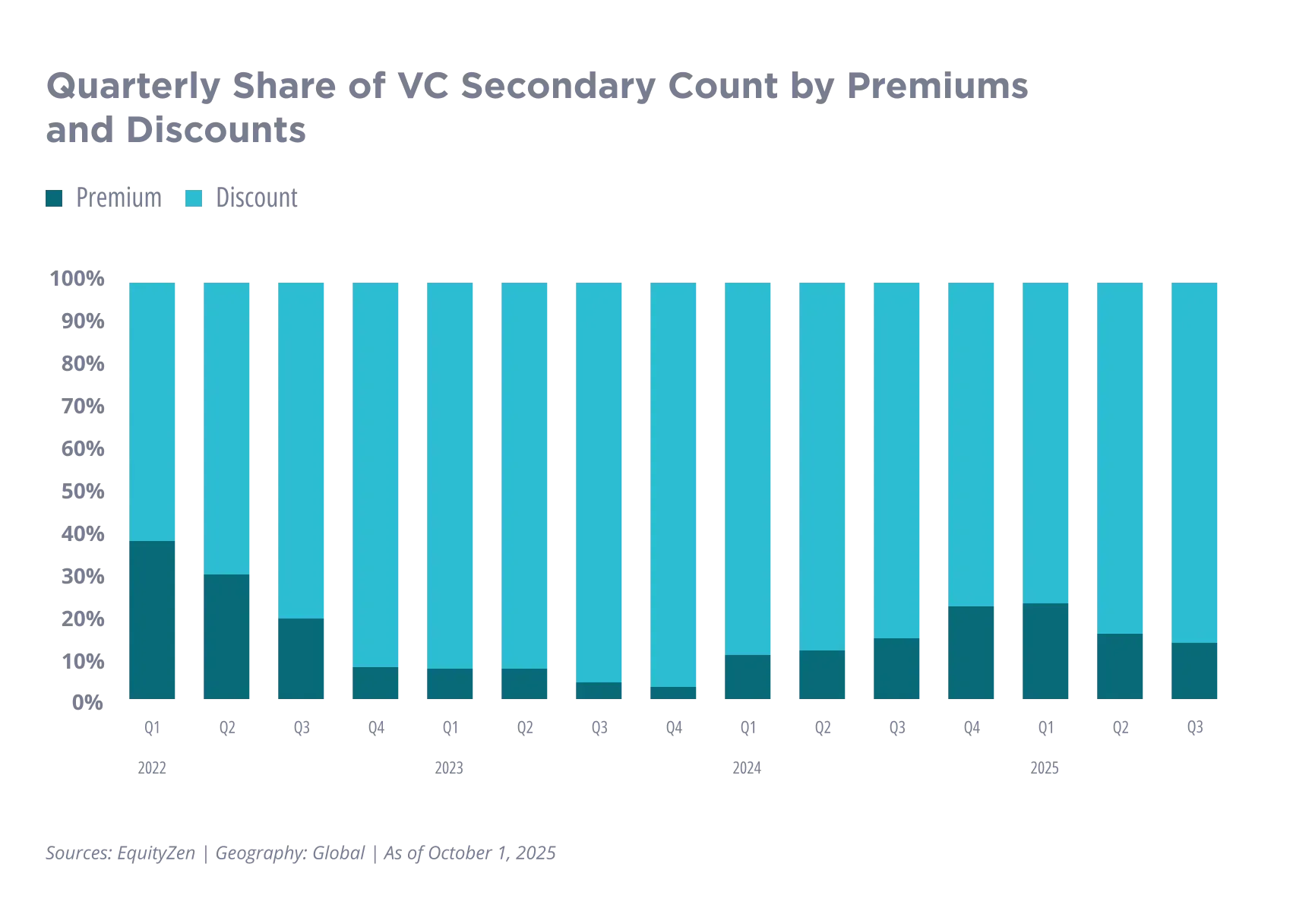

CHART OF THE WEEK

As private markets reset, secondary pricing has become a clear gauge of sentiment. Most transactions in the past three years have cleared at discounts to the last primary round, with some quarters approaching ninety percent of all deals. Premiums are limited to a small group of companies that continue to compound at exceptional rates. For the broader market, this reflects renewed valuation discipline and a necessary adjustment after the peak multiples of 2020 to 2022.

The Stableton Morningstar PitchBook Unicorn 20 is designed for this environment, by providing exposure to the Top 20 private blue-chip technology companies and enabling strategic entry at market driven pricing.

THE UNTOLD UNICORN STORY

Figure AI: Creating the future of human-robot collaboration

Brett Adcock, Founder & CEO of Figure AI. (20)

Figure AI is redefining the future of work through humanoid robotics. Founded in 2022, the company’s mission is to build general-purpose robots that can think, move, and assist in the real world.

At the heart of Figure’s progress is Helix, an AI system that combines vision, language, and action. It allows robots to interpret complex commands, understand their surroundings, and operate safely alongside people. Backed by partners such as OpenAI, Microsoft, NVIDIA, and BMW, Figure is rapidly advancing from research to large-scale deployment. Their vision is ambitious: create machines that complement human labor, performing useful tasks across industries from manufacturing to logistics. (21)

Fun Fact: Figure 01 learned to make coffee by watching just 10 hours of video footage of humans doing it. In a demonstration at Figure's San Francisco headquarters, when asked to make coffee, the robot responded autonomously operated a Keurig machine, all while self-correcting its own mistakes in real time.

Did you know? Figure AI is one of the 20 companies in our Stableton Morningstar PitchBook Unicorn 20 strategy, a systematic, index-like approach that aims to outperform public benchmarks with low-cost fees, and without a performance fee. Click below for more information.

SOURCES

1 - Bloomberg, 2 - Anduril, 3 - Financial Times, 4 - Fortune, 5 - The Register, 6 - Florida Politics, 7 - Coindesk, 8 - Financial Times, 9 - Tech Crunch, 10 - CNBC, 11 - Business Wire, 12 - Fintech Magazine, 13 - Stripe, 14 - Business Insider, 15 - The Information, 16 - CNBC, 17 - Financial Times, 18 - Financial Times, 19 - Business Wire, 20 - AP News, 21 - CNBC

Every Wednesday, the Navigator delivers a digest of news from our portfolio holdings and key trends shaping private tech investing. Subscribe to receive it directly in your inbox.