xAI and Anthropic Funding Surge, SpaceX Secures $739M, OpenAI–SoftBank Bet on Infrastructure

By Stableton on January 14th, 2026

This week signals momentum at the top of private markets. Across AI, space, and compute, private tech leaders are setting the next phase of growth. Let’s dive in…

THIS WEEK’S BREAKING NEWS

AI mega-rounds accelerate in back-to-back raises

xAI and Anthropic have lined up back-to-back funding rounds that underscore the pace and scale of capital flowing into frontier AI.

On January 6, xAI closed an upsized $20B Series E, exceeding its $15B target, with participation from Fidelity, QIA, MGX, NVIDIA, and Cisco. The capital is earmarked for massive GPU infrastructure expansion and the continued rollout of Grok models across consumer and enterprise products. (1)

The following day, Anthropic moved to raise $10B at a $350B valuation, nearly doubling its valuation in four months. The round, expected to be led by GIC and Coatue, follows a $13B raise in September and reflects sustained institutional demand for scaled AI platforms. Anthropic is targeting breakeven by 2028 and an IPO as early as this year. (2)

MARKET UPDATE

Middle East IPO market bets on 2026 pricing

Middle East IPO activity slumped to its weakest level in five years in 2025, with volumes stuck below $6B. A recovery now hinges on whether a small number of high-profile listings in early 2026 can price and trade well enough to restore investor confidence. Without strong aftermarket performance, the region’s equity capital markets risk another stalled year. (3)

STABLETON MORNINGSTAR PITCHBOOK UNICORN 20 STRATEGY

The Stableton Morningstar PitchBook Unicorn 20 strategy is the world’s first passive, systematic, and semi-liquid approach to investing in the Top 20 privately held tech companies before they go public.

This strategy offers a straightforward and cost-effective way to gain exposure to leading private technology companies within a single portfolio. With no performance fees and enhanced liquidity, it offers a unique alternative to traditional private market investments.

PORTFOLIO NEWS

Anduril founder supports defense pay caps amid U.S. drone push

Palmer Luckey said he does not oppose proposed limits on executive pay for defense contractors floated by Donald Trump. Luckey argued that when companies rely on public funds, the government should be able to impose restrictions if contractors fall behind on commitments. He highlighted Anduril’s $900M Arsenal-1 manufacturing facility in Ohio as part of efforts to close the U.S. drone gap with China, noting the project is ahead of schedule. (4)

Responsible AI moves into insurance with Anthropic-Allianz deal

Anthropic and Allianz SE have formed a global partnership to deploy responsible, safety-first AI across Allianz’s insurance operations. The collaboration focuses on three areas: empowering employees with Claude models and developer tools, automating claims and workflows using agentic AI with human oversight, and strengthening transparency and regulatory compliance through fully traceable AI systems. (5)

Claude expands into healthcare as Anthropic targets clinical workflows

Anthropic has launched a new suite of healthcare and life sciences tools for its Claude platform, allowing users and providers to work with medical records, insurance data, and fitness apps to better understand health information. The rollout mirrors a recent move by OpenAI into healthcare and signals intensifying competition in a highly regulated, high-stakes domain. Anthropic emphasized privacy safeguards, HIPAA-ready infrastructure, and human-in-the-loop requirements, positioning Claude as a support tool for navigating healthcare complexity rather than a replacement for medical professionals. (6)

New SEA marketing lead signals Canva’s regional growth push

Canva has appointed Laura Kantor as its new Head of Marketing for Southeast Asia, tasking her with leading brand and growth initiatives across six key markets including Indonesia, Singapore, and Vietnam. Kantor succeeds Ruoshan Tao and will focus on strengthening local teams, sharpening market priorities, and scaling culturally relevant campaigns, building on Canva’s recent push to deepen adoption among MSMEs across the region. (7)

Cursor enters large enterprises through EPAM partnership

EPAM Systems and Cursor have entered a partnership to help global enterprises move from experimental AI coding tools to fully scaled, AI-native engineering teams. By combining Cursor’s AI-native IDE with EPAM’s AI/Run™ delivery, training, and governance frameworks, the alliance targets large-scale deployment, faster time-to-value, and measurable productivity gains in complex enterprise environments. (8)

Databricks becomes the backbone of Toyota’s AI platform

Toyota has adopted Databricks to power vista, its unified data and AI platform designed to break down internal data silos and deliver AI-ready data at scale. Built on the Databricks Data Intelligence Platform, vista integrates corporate, connected, and customer data with centralized governance via Unity Catalog, enabling company-wide analytics, machine learning, and future agentic AI use cases to accelerate Toyota’s digital transformation. (9)

New Databricks tool targets the weakest link in AI agents

Databricks has launched Instructed Retriever, a new retrieval tool designed to improve agentic AI accuracy by moving beyond traditional RAG pipelines. The tool augments retrieval with instructions, schemas, metadata reasoning, and query decomposition to better preserve user intent. Benchmark tests show higher relevance than standard RAG, positioning Instructed Retriever as a key upgrade within Databricks’ Agent Bricks suite for enterprise AI agents. (10)

OpenAI tests health data integration inside ChatGPT

OpenAI has launched ChatGPT Health in the U.S., allowing users to share medical records and data from health apps to receive more personalized responses. The company says health chats are stored separately and excluded from model training, stressing the tool is not for diagnosis or treatment. Privacy advocates, however, warn that handling sensitive health data raises risks, especially amid growing commercialization pressures. (11)

OpenAI and SoftBank double down on AI infrastructure

OpenAI and SoftBank will jointly invest $1B in SB Energy to support large-scale data-centre and energy infrastructure for OpenAI’s Stargate project in Texas. Each will commit $500M. The deal deepens SoftBank’s vertically integrated bet across AI models, compute, and power, while amplifying investor concerns about capital intensity versus near-term revenues. (12)

Zeta and OpenAI bet on agentic, answer-driven marketing

Zeta Global announced a collaboration with OpenAI to power Athena by Zeta, an agentic, answer-driven marketing system for enterprises. OpenAI models will underpin Athena’s conversational intelligence as Zeta expands beta access to its first two agentic apps, Insights and Advisor, aimed at turning marketer questions into decision-ready actions inside daily workflows. (13)

Samsung bets on Perplexity to finally fix Bixby

Samsung is preparing a major Bixby reboot in One UI 8.5, with leaked screenshots showing Perplexity AI powering Bixby’s answers to complex queries. Instead of relying on its own limited knowledge base, Bixby appears to route research-style questions to Perplexity, returning cited, web-grounded responses. A new Bixby Live interface and deeper third-party integrations suggest Samsung is repositioning Bixby as a modern, conversational assistant rather than a basic voice shortcut. (14)

Revolut looks to buy FUPS as Turkey gateway

Revolut is in talks to acquire Turkish digital bank FUPS as a potential entry point into Turkey, pending approval from the local banking regulator (BDDK). The move would mark another step in Revolut’s global expansion following recent pushes into the Nordics and Mexico. Turkey’s banking market is digitally advanced but still branch-heavy, making execution and differentiation critical if the deal proceeds. (15)

Spain becomes a core growth engine for Revolut

Revolut has surpassed 6 million users in Spain, reaching 13% market penetration and becoming the fourth-largest bank by customer reach, ahead of ING and Banco Sabadell. Spain is now Revolut’s third-largest market globally, driven by strong adoption of savings, investments, and cash services, alongside early moves into physical infrastructure such as ATMs. (16)

Ripple clears UK regulatory hurdle with FCA approval

Ripple has secured FCA authorization in the UK, receiving both an Electronic Money Institution license and crypto asset registration. The approvals allow Ripple to expand regulated payment and digital asset services, aligning with the UK’s roadmap to bring crypto assets fully under financial regulation by 2027. (17)

SpaceX wins $739M Space Force launch orders under NSSL Phase 3

The U.S. Space Force awarded $739M in national security launch orders to SpaceX, assigning nine missions under NSSL Phase 3 Lane 1 for the Space Development Agency and the National Reconnaissance Office. The missions support missile warning, tracking, and intelligence constellations in low Earth orbit, reinforcing SpaceX’s dominance in cost- and cadence-focused national security launches. (18)

Stripe brings crypto payments to online merchants

Stripe will enable crypto-funded payments through a new partnership with Crypto.com, allowing consumers to pay Stripe merchants using digital currencies starting this month. The move reflects growing interest among payment processors in crypto and stablecoins, though adoption will hinge on consumer demand and regulatory clarity. (19)

Shopping comes to Copilot as Stripe embeds checkout in chat

Stripe is powering Copilot Checkout, enabling users in the US to discover and buy products directly inside Microsoft Copilot chat. The experience uses Stripe’s agentic commerce stack, including the Agentic Commerce Protocol and shared payment tokens, allowing secure, native checkout while merchants retain control and fraud protection. (20)

Mississippi lands xAI’s biggest bet yet with $20B AI data center

xAI plans to invest $20B to build a 2-gigawatt data center in Southaven, Mississippi, its largest project to date and the state’s biggest private investment. The project promises jobs and capacity for what xAI calls the world’s largest supercomputer, but has triggered environmental and community opposition and relies on significant tax incentives. (21)

OTHER NEWS

Polymarket’s Venezuela ruling reignites insider-trading concerns

Polymarket is refusing to settle more than $10.5M in wagers on whether the US “invaded” Venezuela, arguing that a special forces raid to capture Nicolás Maduro does not meet its contract definition of an invasion. The dispute has angered traders, revived insider-trading concerns, and highlighted governance risks in prediction markets. (22)

Discord files confidentially for IPO as tech listings rebound

Mistral AI has secured a strategic deal with France’s military, beating US tech giants as Paris pushes for AI sovereignty. The agreement deploys Mistral’s models on French-controlled infrastructure, reinforcing Europe’s bet on homegrown AI for sensitive defense use cases. (23)

France’s armed forces choose Mistral over US AI giants

Polymarket and Parcl are partnering to launch real estate prediction markets that settle against Parcl’s daily housing-price indices, offering a transparent, data-driven reference for forecasting property price movements. Initial markets focus on major U.S. metros with standardized templates and independent settlement values, lowering complexity in expressing directional views on housing trends. (24)

ByteDance valuation set near $370B in HSG rollover fund

ByteDance could be valued at $350–370 billion as HSG raises a continuation fund to roll over part of its stake. The move crystallizes gains after strong revenue growth, rising AI momentum via Doubao, and active secondary market pricing. (25)

Lambda explores $350M pre-IPO raise ahead of 2026 listing

Lambda is reportedly in talks to raise $350 million in pre-IPO funding, with Mubadala Capital in discussions to lead the round. The company is now targeting an H2 2026 IPO, following rapid revenue growth and major capacity deals with Microsoft and Nvidia. (26)

Plaid adds Jelena McWilliams as President of Corporate Affairs

Plaid has appointed former FDIC Chair Jelena McWilliams as President of Corporate and External Affairs, strengthening the fintech’s regulatory, policy, and government relations bench as scrutiny of financial infrastructure and consumer protection intensifies. (27)

CHART OF THE WEEK

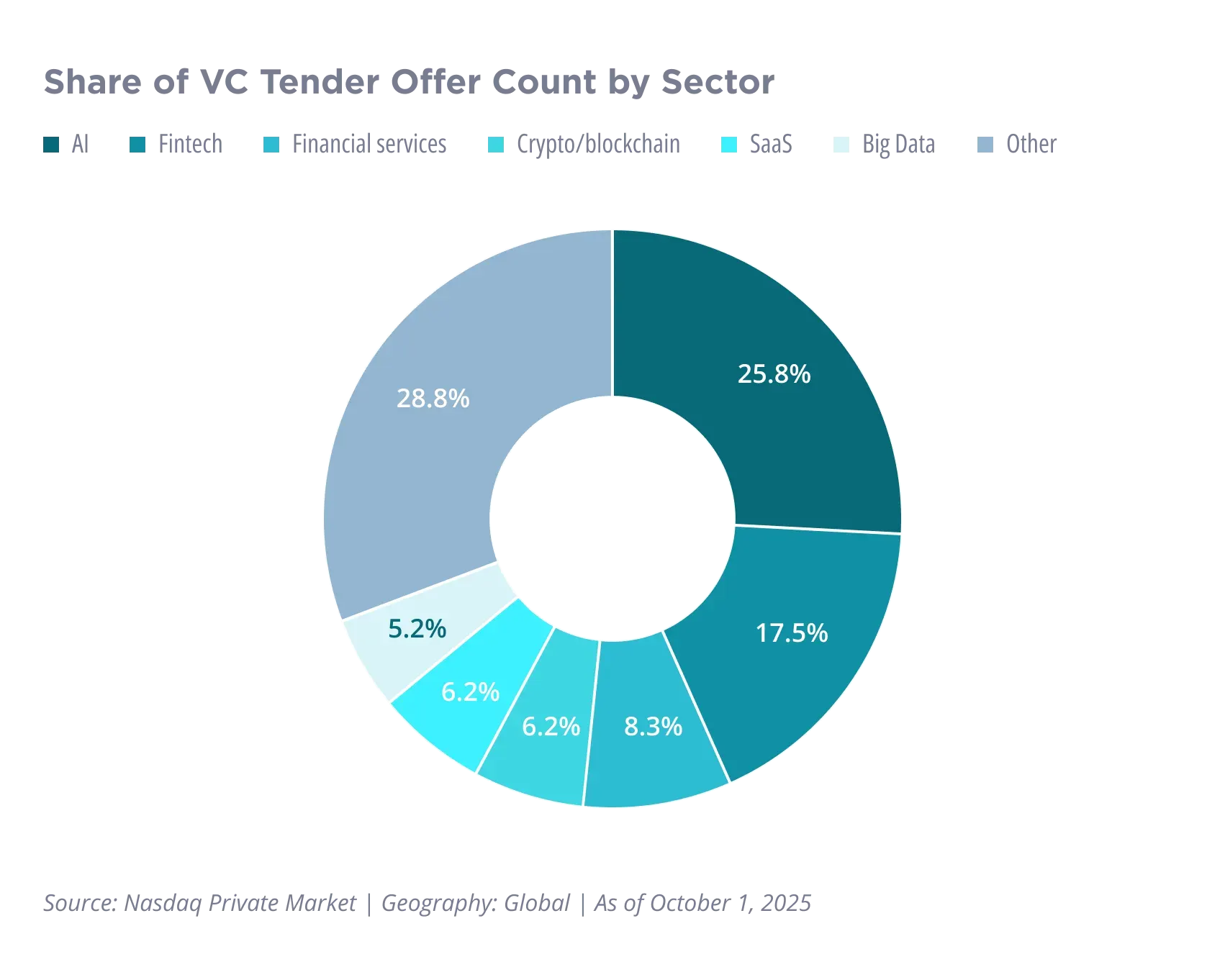

Tender offers highlight where private companies feel the strongest liquidity needs. AI leads by a wide margin, reflecting rapid growth and a need to manage employee and shareholder liquidity as valuations rise. Fintech and financial services follow, together making up a sizable share due to regulatory demands and ongoing capital requirements. Smaller but notable levels come from SaaS, crypto, and big data.

Liquidity behavior like this often signals where the most durable private market momentum exists. The Stableton Morningstar PitchBook Unicorn 20 is positioned in these private blue-chip technology segments, providing an index investing approach to companies with scale, durability, and relevance across cycles.

THE UNTOLD UNICORN STORY

Anysphere: From MIT project to the future of coding

Co-founder and CEO, Anysphere, Michael Truell, at a convention talk. (28)

When Michael Truell and his co-founders launched Anysphere in 2022, they weren't chasing unicorn status; they were solving their own frustration. Long hours spent debugging and rewriting the same functions led them to an idea: what if AI could help developers reason through entire projects, not just autocomplete lines? That experiment led to Cursor, Anysphere’s AI-powered development environment that thinks like a collaborator.

The idea took off. Its platform now powers workflows for teams across the Fortune 500, helping engineers code faster and smarter. Anysphere is shaping a new reality where writing software feels less like typing commands and more like talking to an intelligent partner.

Fun Fact: Anysphere prohibits the use of AI tools during the first round of coding interviews, which is a notable irony for a company whose entire product is an AI coding assistant. (29)

Did you know? Anysphere is one of the 20 companies in our Stableton Morningstar PitchBook Unicorn 20 strategy, a systematic, index-like approach that aims to outperform public benchmarks with low-cost fees, and without a performance fee. Click below for more information.

SOURCES

1 - The Wall Street Journal, 2 - xAI, 3 - Bloomberg, 4 - Bloomberg, 5 - Allianz, 6 - NBC News. 7 - Marketing Interactive, 8 - EPAM, 9 - Databricks, 10 - TechTarget, 11 - BBC, 12 - Financial Times, 13 - Business Wire, 14 - Android Authority, 15 - Bloomberg, 16 - Finance Magnates, 17 - The Block, 18 - SpaceNews, 19 - Payments Dive, 20 - Stripe, 21 - ABC News, 22 - Financial Times, 23 - Bloomberg, 24 - Business Insider, 25 - Reuters, 26 - Data Center Dynamics, 27 - Banking Dive, 28 - The Signal, 29 - Tech Funding News

Every Wednesday, the Navigator delivers a digest of news from our portfolio holdings and key trends shaping private tech investing. Subscribe to receive it directly in your inbox.