Kraken Eyes Prediction Markets in 2026, OpenAI Explores Ads in ChatGPT, Anthropic Unveils Bloom

By Stableton on December 31st, 2025

Here’s what stood out this week across our portfolio holdings: Kraken lines up prediction markets, OpenAI tests ads, and Anthropic opens how AI behavior is measured. Let’s dive in…

THIS WEEK’S BREAKING NEWS

Kraken confirms prediction markets push, eyes 2026 launch

In a televised CNBC interview, Kraken’s global head of consumer, Mark Greenberg, said the exchange is actively exploring prediction markets as part of a broader strategy to expand information-driven trading alongside crypto and tokenized assets. Co-CEO Arjun Sethi has reinforced a likely 2026 launch timeline, framing prediction markets as a natural extension of Kraken’s existing liquidity and trading infrastructure. The move comes amid rising regulatory acceptance, surging volumes in event-based contracts, and growing institutional interest, as major exchanges increasingly move to integrate prediction markets into core platforms. (1)

MARKET UPDATE

AI mega-rounds reshape late-stage private markets

AI start-ups raised a record $150 billion in 2025, surpassing the $92 billion peak of 2021, as late-stage investors pushed founders to build “fortress balance sheets” ahead of a potential AI downturn in 2026. Mega-rounds, including OpenAI’s $41 billion and Anthropic’s $13 billion, concentrated capital in perceived category winners, while smaller firms struggled. Investors increasingly favor scale, balance-sheet resilience, and acquisition optionality over breadth of venture exposure. (2)

Poor tech IPO performance clouds outlook for new listings

More than two-thirds of tech IPOs this year are trading below their listing prices, with a median decline of 9% versus an 18% gain in the S&P 500, prompting many companies to delay or rethink 2026 listings. Investor appetite has narrowed toward large, “must-own” names such as SpaceX and Anthropic, while weaker debuts by firms like Klarna and Navan have exposed a growing trust gap around valuation discipline, projections, and insider selling. (3)

STABLETON MORNINGSTAR PITCHBOOK UNICORN 20 STRATEGY

The Stableton Morningstar PitchBook Unicorn 20 strategy is the world’s first passive, systematic, and semi-liquid approach to investing in the Top 20 privately held tech companies before they go public.

This strategy offers a straightforward and cost-effective way to gain exposure to leading private technology companies within a single portfolio. With no performance fees and enhanced liquidity, it offers a unique alternative to traditional private market investments.

PORTFOLIO NEWS

China sanctions U.S. defense firms, including Anduril CEO, over Taiwan arms sales

China imposed sanctions on 20 U.S. defense companies and 10 senior executives, including Anduril founder Palmer Luckey, in direct retaliation for Washington’s approval of a record-sized arms sale to Taiwan valued at over $10 billion. Measures freeze sanctioned assets in China, bar business and entry, and underscore Beijing’s designation of Taiwan as a core national interest while amplifying geopolitical risk for defense supply chains and strategic technology partners. (4)

Fraud charges tied to Anduril shares surface in pre-IPO market

Giovanni Pennetta, manager of Sestante Capital, has been charged with securities and wire fraud for allegedly misleading investors by claiming access to pre-IPO Anduril shares. Prosecutors allege millions were misappropriated, underscoring persistent governance and verification risks in opaque late-stage private markets where demand for marquee defense-tech names continues to outpace reliable access. (5)

Anthropic unveils Bloom, open-source AI behavior evaluation framework

Anthropic has released Bloom, an open-source agentic framework that automates behavioral evaluations of frontier AI models by generating large sets of targeted scenarios to quantify specific behaviors’ frequency and severity, significantly reducing manual effort and keeping pace with rapidly evolving architectures. Bloom benchmarks 16 models across traits like bias, sabotage and self-preservation, accelerating systematic, scalable alignment research. (6)

OpenAI seeks new head of preparedness to manage AI risks

OpenAI is recruiting a Head of Preparedness to lead its preparedness framework, tasked with anticipating and mitigating emerging risks from advanced AI models - from cybersecurity vulnerabilities to mental health and biological threats. CEO Sam Altman underscores the role’s strategic importance and high stakes, offering a competitive package (≈ $555,000 + equity) as the company doubles down on safety leadership amid evolving regulatory and capability challenges. (7)

SoftBank races to fulfill $22.5B funding commitment to OpenAI by year-end

SoftBank Group is accelerating efforts to deliver a $22.5 billion funding commitment to OpenAI by the end of 2025, selling major stakes such as its entire $5.8 billion Nvidia holding and $4.8 billion in T-Mobile shares, slowing other Vision Fund deployments, and exploring asset sales and margin loans to meet its obligations. The move underscores SoftBank’s deep strategic bet on AI infrastructure and compute dominance amid intensifying competition. (8)

Indonesia appoints OpenAI OpCo as digital VAT collector

Indonesia has designated OpenAI OpCo, LLC as one of 254 digital VAT collectors under its Electronic-Based Trading System, mandating it to withhold and remit value-added tax on digital services. This aligns with Jakarta’s broader digital tax regime that has already generated ~$2.7 billion in revenue from international tech giants, reflecting Southeast Asia’s shift toward formalizing digital economy taxation. (9)

OpenAI’s ads push starts taking shape

OpenAI is actively exploring advertising inside ChatGPT, testing sponsored results, sidebar placements, and commerce-linked ads triggered by clear purchase intent without modifying its core model. With nearly 900 million weekly active users and ambitions to reach 2.6 billion by 2030, the company sees ads as a way to monetize free users, projecting up to $110 billion in revenue through 2030 while carefully balancing user trust, disclosure, and long-term platform credibility. (10)

Samsung integrates Perplexity AI into Bixby with One UI 8.5

Samsung is adding Perplexity-powered AI alongside Bixby in its upcoming One UI 8.5 update, enabling generative search and conversational responses across the operating system. The enhancements focus on context-aware assistance, smarter device search, and deeper on-device intelligence, strengthening Samsung’s AI positioning while increasing ecosystem engagement and user retention. (11)

Ukraine central bank links Revolut account closures to licensing gaps

Ukraine’s central bank said Revolut’s recent account closures stem from the company operating without a local banking license, rather than from political or sanctions-related pressure. The regulator emphasized that foreign fintechs must meet domestic licensing and supervisory requirements to offer services, reinforcing regulatory discipline as cross-border digital banking expands. (12)

Ripple infrastructure gains traction in European core banking

Ripple’s settlement technology, delivered through the TAs network gateway, is being adopted by European banks seeking faster and lower-cost cross-border payments. The integration supports real-time settlement and improved liquidity management, highlighting growing institutional interest in blockchain-based infrastructure as part of core banking modernization efforts. (13)

U.S. Space Force partners with SpaceX on 480-satellite MilSat-Net constellation

The U.S. Space Force and SpaceX are collaborating to develop MilSat-Net, a constellation of approximately 480 satellites designed to provide resilient, global military communications. SpaceX will integrate military payloads with its next-generation Starshield and Starlink platforms, enhancing redundant joint force connectivity and positioning commercial space capabilities at the center of future defense communications infrastructure. (14)

Stripe deepens UK retail penetration via Currys payments partnership

Stripe is partnering with Currys, a UK electronics retailer, to modernize its payments infrastructure across digital and physical channels. The collaboration underscores Stripe’s growing role in large-scale retail transformation, as merchants prioritise unified payment platforms to improve checkout performance, resilience, and omni-channel economics. (15)

OTHER NEWS

ByteDance plans $23bn AI investment to keep pace with U.S. tech rivals

ByteDance is preparing to spend around RMB160bn ($23bn) on AI infrastructure in 2026, up from RMB150bn this year, with roughly half earmarked for advanced semiconductors. The TikTok owner is accelerating investment to narrow the gap with U.S. Big Tech, despite export controls limiting access to Nvidia’s most advanced chips, and is increasingly relying on overseas data centre capacity to train and deploy models globally. (16)

ByteDance advances AI smartphone partnerships with Chinese OEMs

ByteDance is moving forward with AI-focused smartphone collaborations with manufacturers including Vivo, Lenovo, and Transsion, embedding its large language models and consumer AI services directly into devices. The strategy aims to expand distribution beyond apps, deepen user engagement, and strengthen ByteDance’s position in consumer AI as competition intensifies across China’s handset and platform ecosystems. (17)

ByteDance reportedly seeks $5.6B purchase of Huawei Ascend AI chips

ByteDance is planning to acquire up to $5.6 billion worth of Huawei’s Ascend AI processors as it scales domestic compute capacity amid U.S. export restrictions. The move underscores growing reliance on Chinese semiconductor alternatives and highlights how leading tech groups are reshaping AI infrastructure strategies to secure long-term model training and inference capacity under constrained supply conditions. (18)

Nvidia to acquire AI chip startup Groq in ~$20B deal

Nvidia has agreed to buy AI chip maker Groq for about $20 billion in cash and stock, in what would be one of the largest semiconductor acquisitions ever. The deal accelerates Nvidia’s strategy to dominate custom AI accelerator silicon at a time when demand for high-performance chips is surging across cloud, enterprise and generative AI workloads, and reinforces its lead against rivals in the global AI infrastructure stack. (19)

Kalshi and Polymarket post record-high volumes with ~$8B in November

Prediction market platforms Kalshi and Polymarket saw their strongest month yet, generating nearly $8 billion in combined trading volume in November. The surge reflects growing institutional and retail interest in event-driven financial derivatives, expanded market offerings, and heightened macro- and crypto-linked activity, underscoring the growing utility of regulated and peer-to-peer markets for hedging and speculation. (20)

Polymarket hack stems from third-party oracle vulnerability

Polymarket disclosed that a third-party price oracle vulnerability was exploited, leading to a security breach that impacted certain markets on the prediction platform. The team is collaborating with external security experts to assess the incident, mitigate risks, and strengthen oracle integrations, highlighting ongoing operational and smart contract risks inherent in decentralized event-based financial market infrastructures. (21)

CHART OF THE WEEK

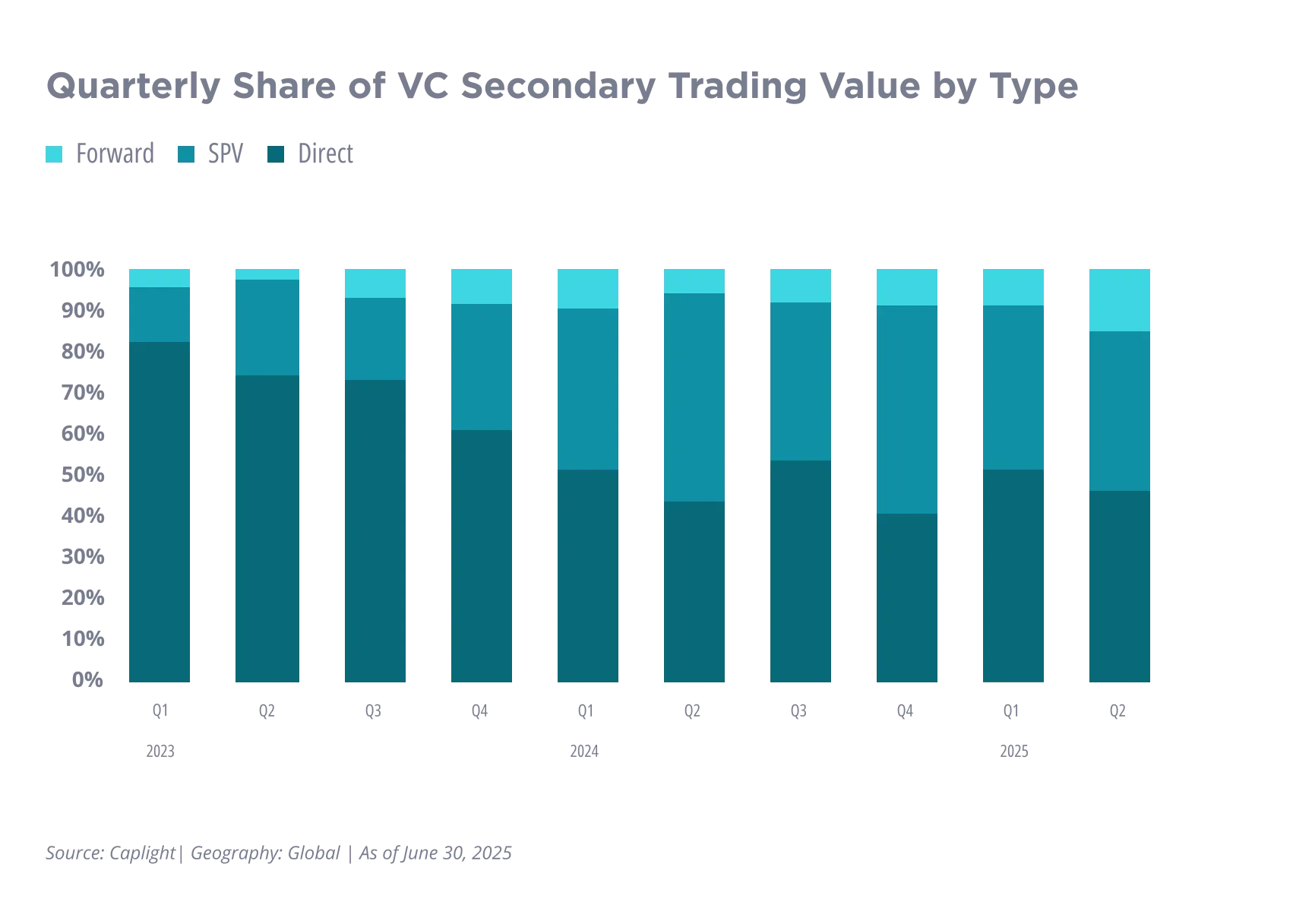

Market execution has tightened significantly over the past two years, creating a more stable environment for large transactions. Direct trades sit at the core because they give institutions a straightforward and dependable way to deploy or adjust meaningful positions. Their continued dominance signals a market where experienced counterparties prefer clean processes, clear pricing, and full control. At the same time, the rise of SPVs has become a defining feature of this cycle. Their growing share shows that capital aggregation has become an essential tool for accessing high demand deals and navigating allocation constraints. This is no longer a workaround. It is a structural part of how venture secondaries function.

These two channels now form the backbone of execution in late stage private technology. The Stableton Morningstar PitchBook Unicorn 20 operates within this framework. By using both direct trades and SPVs to source, price, and size positions with institutional standards, investors gain exposure to the companies that matter most.

THE UNTOLD UNICORN STORY

Epic Games: From curiosity to industry revolution

Epic Games CEO Tim Sweeney. Source: The Verge (22)

In 1991, Tim Sweeney founded Epic Games, a company that would later redefine the gaming industry with groundbreaking titles like Fortnite and the Unreal Engine. Known for its impressive graphics and adaptability, the Unreal Engine has expanded beyond gaming, influencing fields like film, VR, architecture, and automotive design. Epic Games remains at the forefront of technological innovation, continuously enhancing the digital entertainment experience.

Fun Fact: Tim grew up experimenting with technology and dismantling items like lawnmowers and TVs to learn how they worked. His curiosity also extended to gaming, where he played Super Mario Bros. to analyze game mechanics—a habit that sparked his passion for game development. (23)

Did you know? Epic Games is one of the 20 companies in our Stableton Morningstar PitchBook Unicorn 20 strategy, a systematic, index-like approach that aims to outperform public benchmarks with low-cost fees, and without a performance fee. Click below for more information.

SOURCES

1 - CNBC Television (YouTube), 2 - Financial Times, 3 - The Information, 4 - Fortune, 5 - Dispatch, 6 - Silicon Angle, 7 - TechCrunch, 8 - Reuters, 9 - Jakarta Globe, 10 - The Information, 11 - Android Police, 12 - Finance Magnates, 13 - Coin Paper, 14 - SAT News, 15 - Retail Times, 16 - Financial Times, 17 - TechNode, 18 - TechNode, 19 - CNBC, 20 - The Block, 21 - The Block, 22 - The Verge, 23 - Business Insider

Every Wednesday, the Navigator delivers a digest of news from our portfolio holdings and key trends shaping private tech investing. Subscribe to receive it directly in your inbox.